especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website. However, does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or the results obtained from the use of such information. is not SEBI registered Advisors and advises its users to check with certified and SEBI registered experts before taking any investment decision. The views and investment tips expressed by investment experts on are their own and not that of the website or its management. has taken due care and caution to compile the data for its Website. If you like the post please share with your friends and others Nifty, Bank Nifty futures prediction for (1st-4th Dec) week 2020.Īlso read, Algo Trading Definition: Pros and Cons of Algorithmic trading Traders can follow our Daily Morning market views and can follow our Nifty and Bank Nifty futures prediction for tomorrow 2nd Dec. Investors have ignored the drop in the PMI Manufacturing numbers. FIIs are continuously buying in the cash market is another positive sign for the markets.

Indian stock markets gained today due to positive cues from the Asian peers, better than expected GDP numbers, and strong auto sales numbers. Then you should Sell with the 1st Target of 29585 during the day with a Stop Loss of 29950.

If the Bank Nifty futures share price Moves Below 29680 and sustained. Then you should Buy with the 1st Target of 30060 during the day with a Stop Loss of 29680. Suppose Bank Nifty futures share price Moves Above 29950 and sustain. Range-Bound Trend of Bank Nifty Future: All up Moves Initiates Profit Booking (Sale) 30250, whereas All Down Moves Initiates Short Covering (Buy) 29700 The European and US futures indices are also trading in the green today. On the global front, the Asian markets were closed in the green. India’s PMI Manufacturing dropped to 56.3 in November from 58.9 in October. The deficit mainly occurred due to the poor revenue realization. The market upside remained capped as the Union government’s fiscal deficit further widened to Rs 9.53 lakh crore which is nearly 120% of the annual budget estimates at the end of October FY21. Markets added more optimism after the data shared by the Department for promotion of industry and Internal Trade that the FDI inflow rose 15% during the April-September period to $30 billion (Rs 2.2 trillion) as compared to inflows of $26 billion during the same period last year. The better than expected GDP held out hopes for further improvement in consumer demand bouncing back. This is due to the strong performance by the manufacturing sector which helped GDP clock a lower contraction of 7.5%. The market sentiments were positive as India’s economy recovered faster than expected in the September quarter. Manufacturing, IT & Software, Capital Goods, Oil & Gas, Healthcare, and Metals were the top gainers.

#BENCHMARK DEFINITION OF FDI HOW TO#

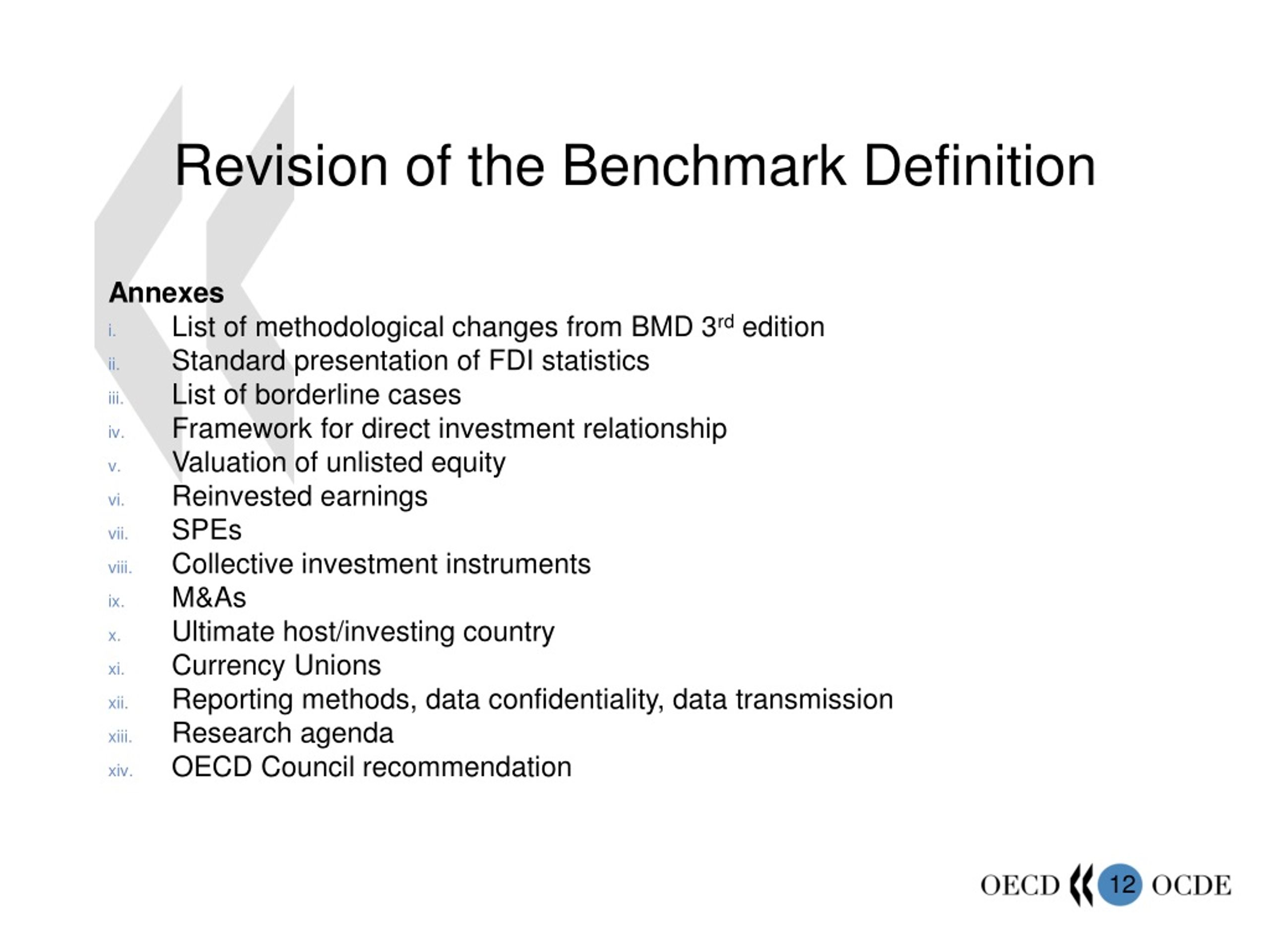

On a sectoral basis, almost all major sectors closed in the green today. To support these standards for FDI statistics, the Benchmark Definition provides guidance on how to compile comprehensive breakdowns by partner country and. The most active stocks for the day in NSE were Bajaj Finance, Reliance, and HDFC. The top losers in the Nifty50 index for the day were Nestle, Kotak Mahindra Bank, Titan Company, NTPC, and Bajaj Finance. Filing requirement also subject to contact by BEA.The top five gainers in the Nifty50 index for the day were GAIL, Sun Pharma, IndusInd Bank, ONGC, UPL.business enterprise owned or controlled, directly or indirectly, by a foreign person or entity at the end of fiscal year 2021. Filing requirement is NOT subject to contact by BEA.business enterprise owned or controlled, directly or indirectly, by a foreign person at the end of 2022. affiliate with an intercompany debt balance with the affiliated foreign group. Also required for each indirectly-owned U.S.affiliate whose assets, sales, or net income (loss) exceed $60 million at any time during the fiscal reporting year. business enterprise when a foreign entity establishes a new legal entity in the United States or expands its operations to include a new facility. business enterprise when a foreign entity acquires a direct or indirect voting interest of at least 10 percent.

0 kommentar(er)

0 kommentar(er)